Is It Still Worth Buying Property in South Africa

Is It Still Worth Buying Property in South Africa?

As the South African real estate market continues to evolve, many potential investors find themselves asking the same question: is it still worth buying property in South Africa? With its stunning landscapes and diverse culture, this country has always held a certain allure for those seeking a slice of paradise. But in recent years, economic and political challenges have cast a shadow of uncertainty over the future of its property market. In this article, we will delve into both the pros and cons of investing in South African real estate, offering a comprehensive analysis that will help you make an informed decision. So, let’s explore the current state of the market and determine whether it is still a worthy venture to own a property in the Rainbow Nation.

Table of Contents

- The Current State of the South African Property Market

- Factors Influencing the Worth of Buying Property in South Africa

- Benefits of Investing in Property in South Africa

- Challenges and Risks of Purchasing Property in South Africa

- Smart Strategies for Investing in the South African Property Market

- Expert Recommendations for Prospective Property Buyers in South Africa

- FAQs

- The Conclusion

The Current State of the South African Property Market

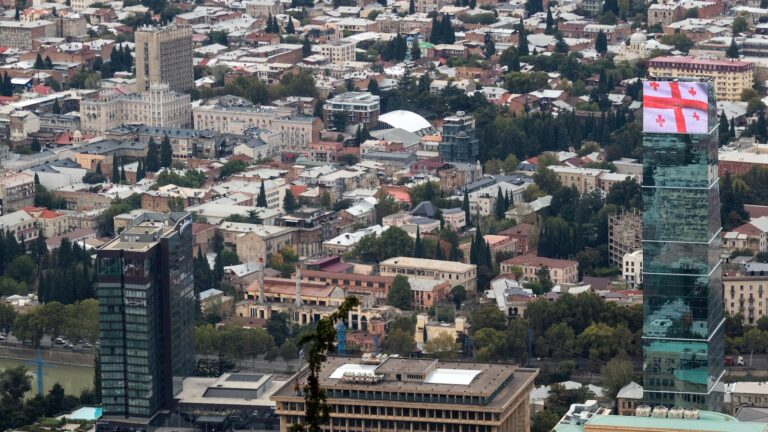

The South African property market is experiencing a dynamic and ever-changing landscape. With a growing economy and a surge in urbanization, the demand for real estate is soaring across the country. One notable trend is the increasing popularity of affordable housing options, catering to the needs of first-time homebuyers and young professionals. This shift is driven by the government’s initiatives to promote accessible housing and reduce the housing backlog. As a result, property developers are focusing on creating affordable housing projects in well-connected locations with access to essential amenities.

In addition, the market is witnessing a rise in the demand for eco-friendly and sustainable properties. With environmental consciousness on the rise, buyers are seeking properties that offer energy-efficient features, such as solar panels and rainwater harvesting systems. Developers are responding to this demand by incorporating green building practices and utilizing eco-friendly materials in construction. Moreover, the concept of communal living is gaining traction, with gated communities and mixed-use developments providing a range of amenities and services, including shared spaces, recreational facilities, and convenient access to retail and dining options.

Overall, showcases an exciting and dynamic industry that is catering to the evolving preferences and needs of buyers. With a focus on affordability, sustainability, and convenience, the market is thriving, offering a diverse range of options for both investors and homebuyers alike.

Factors Influencing the Worth of Buying Property in South Africa

There are several key factors that can influence the value of purchasing property in South Africa.

Firstly, the location of the property plays a significant role in determining its worth. Properties that are situated in prime areas, such as Cape Town or Johannesburg, tend to have higher values due to higher demand and potential for future growth. On the other hand, properties in more rural or less desirable locations may have lower values.

Other factors that can influence the worth of buying property in South Africa include:

- The current state of the economy: A strong economy can lead to increased demand and higher property prices.

- Infrastructure development: Areas with good infrastructure, such as access to transportation and amenities, tend to be more valuable.

- Market trends: Property prices can be influenced by market conditions, such as fluctuations in supply and demand.

- Security: Properties situated in safer neighborhoods or those with additional security features are often more desirable and therefore have higher values.

- Legal and political stability: A stable political and legal environment can provide confidence to investors and have a positive impact on property values.

Considering these factors can help potential buyers make informed decisions and ensure that they invest in properties that hold good value and have the potential for growth in the South African market.

Benefits of Investing in Property in South Africa

Investing in property in South Africa can provide numerous benefits that make it a lucrative venture. Firstly, the country offers a diverse range of investment opportunities, from residential houses to commercial buildings, catering to the preferences of different investors. This allows you to choose the type of property that aligns with your investment goals and strategies.

Secondly, the property market in South Africa has shown consistent growth over the years, making it an attractive option for investors. The demand for housing and commercial spaces remains high, creating a favorable environment for rental income and capital appreciation.

Furthermore, investing in property in South Africa also provides you with a reliable income source through rental yields. Thirdly, you can enjoy a steady stream of rental income by leasing out your property to tenants. This can serve as a passive income stream, allowing you to reap the rewards of your investment on a regular basis.

Lastly, investing in property in South Africa can offer potential tax advantages. Property investors may be eligible for tax deductions on expenses related to their investment, such as maintenance costs and property management fees. These tax benefits can help maximize your return on investment and improve your overall financial position.

Challenges and Risks of Purchasing Property in South Africa

When considering investing in South African real estate, it’s important to be aware of the challenges and risks that may arise. Here are some key factors you should keep in mind:

- Volatility of the market: The South African property market can be quite volatile, making it crucial to stay informed about market trends and property values. Fluctuations in demand and supply, as well as economic conditions, could impact property prices and potential returns on investment.

- Title deed issues: Property ownership disputes have been a concern in South Africa. Ensuring that the title deeds are correctly registered and free from any encumbrances is essential to avoid legal complications and safeguard your investment.

- Crime rates: Unfortunately, crime is a reality in South Africa and can affect the safety of properties. It’s advisable to thoroughly research the area where you plan to purchase, taking into consideration crime statistics and the security measures available in the neighborhood.

- Foreign ownership restrictions: South Africa has certain restrictions on foreign property ownership, and you may need to navigate through legal requirements and regulations. Familiarize yourself with the laws governing non-resident ownership and any limitations that may apply to foreign investors.

- Economic and political stability: South Africa’s economic and political landscapes can impact the property market. Factors such as inflation, interest rates, government policies, and stability can all influence investment opportunities and returns.

- Affordability: While South Africa offers diverse property options, affordability can vary significantly depending on the location. It’s important to carefully assess your budget and consider not only the purchase price but also potential maintenance and running costs.

By being aware of the challenges and potential risks involved in purchasing property in South Africa, you can make informed decisions and mitigate any potential downsides. Thorough research, due diligence, and consulting with professionals in the real estate industry can help ensure a successful investment experience.

Smart Strategies for Investing in the South African Property Market

When it comes to investing in the South African property market, having a solid strategy is key. Here are a few smart strategies to help you make the most out of your investment:

1. Do thorough research: Before diving into the market, it’s important to do your homework. Research the current trends, market conditions, and potential growth areas. Look at factors such as population growth, infrastructure development, and job opportunities. This will give you a better understanding of where to invest your money.

2. Diversify your portfolio: It’s always wise to spread your investments across different areas. Consider investing in both residential and commercial properties to diversify your portfolio. This can help hedge against potential risks and increase your chances of earning a steady return on investment.

3. Consider rental properties: In South Africa, rental properties can be a lucrative investment option. With a growing population and high demand for housing, investing in rental properties can provide a steady stream of income. However, it’s vital to carefully analyze the potential rental yields and costs associated with managing rental properties.

4. Stay updated with the regulations: The property market in South Africa is subject to various regulations and laws. Stay informed about any changes in legislation that may impact your investments. This includes zoning regulations, tenant rights, and tax laws. By staying updated, you can make informed decisions and avoid any legal pitfalls.

By following these smart strategies, you can navigate the South African property market with confidence and maximize your investment potential. Remember, investing in real estate requires careful planning and a long-term outlook. So, make sure to assess your financial goals and risk tolerance before diving in.

Expert Recommendations for Prospective Property Buyers in South Africa

When it comes to buying property in South Africa, it’s crucial to make informed decisions to secure a sound investment. Here are expert recommendations to guide potential property buyers:

- 1. Research extensively: Before diving into the market, conduct thorough research on property prices, locations, and market trends. Familiarize yourself with the different regions in South Africa and determine which areas align with your needs and investment goals.

- 2. Engage a trusted real estate agent: To navigate the complexities of the South African property market, consider enlisting the help of a reputable real estate agent who specializes in the region you are interested in. Their expertise will prove invaluable in finding you the right property and negotiating a fair deal.

- 3. Consider your long-term plans: When choosing a property, think beyond the present and consider your long-term plans. Are you looking for a forever home, rental investment, or a holiday retreat? Understanding your objectives will guide your property search and ensure you make a choice that aligns with your goals.

- 4. Inspect the property: Ensure that you physically inspect any property you are considering purchasing. Look out for potential issues or damages that may impact the property’s value or your enjoyment. If necessary, hire a trusted inspector to thoroughly assess the property’s condition.

- 5. Get familiar with legal requirements: South Africa has specific legal requirements concerning property purchases. It’s essential to familiarize yourself with these regulations to avoid any legal complications down the line. Consult a qualified attorney who specializes in property law to ensure a seamless transaction.

- 6. Secure financing: If you require financing, approach multiple lenders to compare loan terms to find the most favorable deal. Ensure you are comfortable with the interest rates, repayment periods, and applicable fees before committing to a mortgage.

By following these expert recommendations, prospective property buyers in South Africa can approach the market with confidence and maximize their chances of a successful and profitable property purchase.

FAQs

1. Is it still worth buying property in South Africa?

Yes, buying property in South Africa can still be a worthwhile investment, but it depends on various factors.

2. What are the factors to consider when deciding to buy property in South Africa?

Factors to consider include your budget, location preference, market conditions, potential returns, and the current political and economic situation in South Africa.

3. How does the political and economic situation affect property investment in South Africa?

The political and economic situation in South Africa can have a direct impact on property prices, market stability, and investment returns. It is important to stay updated and assess the potential risks associated with the country’s political and economic climate.

4. Are there any specific locations in South Africa that are considered more desirable for property investment?

Certain locations, such as Cape Town, Johannesburg, and Durban, are generally considered more desirable for property investment due to their economic growth, tourism potential, and infrastructure development. However, it is essential to research and analyze specific areas before investing.

5. What are the potential returns on property investment in South Africa?

Property investment in South Africa can offer attractive returns, especially in popular areas experiencing high demand. However, it is important to conduct thorough market research and consider factors such as rental demand, property appreciation, and potential risks in order to assess the expected returns.

6. Are there any risks associated with buying property in South Africa?

Yes, like any real estate market, there are risks involved in buying property in South Africa. These may include fluctuations in property prices, unstable market conditions, legal complexities, and potential issues related to tenant management or property maintenance.

7. Are there any regulations or restrictions for foreign investors looking to buy property in South Africa?

Foreign investors may face certain regulations or restrictions when buying property in South Africa. It is essential to consult with local authorities or seek legal advice to understand the specific requirements and limitations that may apply.

8. Should I consider buying property for personal use or as an investment?

The decision to buy property for personal use or as an investment depends on your individual circumstances and financial goals. Consider factors such as your long-term plans, financial stability, market conditions, and potential rental income before making a decision.

9. What should I do before buying property in South Africa?

Before buying property in South Africa, it is crucial to do thorough research, visit the desired locations, consult with real estate professionals or lawyers, analyze market trends, assess potential risks, and ensure you have the necessary finances in place.

10. Can I finance my property purchase in South Africa?

Yes, it is possible to finance your property purchase in South Africa through local banks or financial institutions. However, the availability of financing and specific requirements may vary, so it is advisable to consult with lenders to understand the options available to you.

In Summary

In conclusion, the question remains: Is it still worth buying property in South Africa? While the decision ultimately depends on individual circumstances, it is crucial to consider the evolving real estate market in the country. With fluctuating economic conditions, political uncertainties, and a history of social inequalities, caution is advised when making such a significant investment. However, South Africa still boasts thriving regions, attractive property prices, and potential for growth. It is essential to conduct thorough research, consult with experts, and evaluate your own objectives before making a final decision. Ultimately, only you can determine if the rewards outweigh the risks in the complex world of South African property.