How Much Money Is Considered Rich in Spain

Have you ever wondered how much money is considered “rich” in Spain? Forget about fancy words and unnecessary fluff, because in this article, we’re getting straight to the point. We’ll unravel the secrets behind what it means to be financially well-off in Spain, providing a clear picture of wealth in this beautiful Mediterranean country. So, get ready to dive into the world of Spanish riches without any distractions!

Table of Contents

- The Definition of Wealth in Spain: Examining the Factors That Determine Financial Success

- Understanding Spain’s Economic Landscape: Analyzing the Average Income and Living Costs

- Wealth Distribution in Spain: Revealing the Gap Between the Rich and the Rest

- Lifestyle Indicators of Richness in Spain: Uncovering the Markers of Affluence

- Strategies to Attain Financial Success in Spain: Tips for Accumulating Wealth

- Navigating Spain’s Tax System: Minimizing Financial Burdens for the Wealthy

- FAQs

- In Summary

The Definition of Wealth in Spain: Examining the Factors That Determine Financial Success

In Spain, one’s financial success can be attributed to various factors that collectively define wealth. Here is a closer look at these influential elements:

1. Educational Attainment: A key determining factor in financial success is the level of education one has achieved. Higher education levels often correlate with higher-paying jobs and increased opportunities for career advancement.

2. Occupational Field: The industry in which a person works can significantly impact their financial prosperity. Sectors such as finance, technology, and engineering tend to offer higher salaries and greater potential for growth.

3. Entrepreneurship: Venturing into entrepreneurial endeavors is a pathway to financial success for many individuals in Spain. Starting and running a successful business can generate substantial wealth, driving economic growth and personal prosperity.

4. Social Capital: Building a strong network of professional relationships and connections plays a crucial role in one’s financial journey. Social capital provides access to valuable resources, business opportunities, and potential investors.

5. Financial Literacy: Understanding financial concepts, managing personal finances effectively, and making informed investment decisions are fundamental skills that contribute to long-term financial success.

6. Saving and Investing: Practicing disciplined savings and investing habits is paramount in accumulating wealth. Making wise investment choices and maintaining a diversified portfolio can generate passive income and secure financial stability.

By analyzing these factors, we gain valuable insights into the intricacies of financial success in Spain and how individuals can shape their own path towards wealth accumulation.

Understanding Spain’s Economic Landscape: Analyzing the Average Income and Living Costs

When it comes to understanding Spain’s economic landscape, it becomes crucial to analyze the average income and living costs. By delving into these aspects, we gain valuable insights into the financial realities of the country.

Let’s start with the average income in Spain. While it varies across regions and professions, the median annual salary provides a useful benchmark. As of 2021, the median income in Spain is around €25,000. However, it’s important to note that this figure can fluctuate significantly depending on factors such as education level, work experience, and industry. Additionally, the minimum wage in Spain is currently €1,050 per month, though legislative changes could impact this in the future.

Now, let’s shift our focus to living costs in Spain. While the expenses can differ based on personal choices and location, there are certain common expenditures to consider. Here are some key facets:

- Housing: Renting or purchasing a home is one of the most significant expenses for individuals and families. Prices can vary, but on average, a one-bedroom apartment in a major city can cost around €800-€1,200 per month.

- Utilities: Electricity, water, heating, and internet are essential services, and the average monthly cost for these utilities could range from €80-€150.

- Transportation: Public transportation, such as buses and trains, is generally affordable, with a monthly pass costing approximately €40. However, owning a car can entail additional expenses like fuel, insurance, and parking.

- Food: The cost of groceries and dining out can vary based on personal preferences, but a rough estimate for monthly expenditure on food is around €200-€400.

By analyzing the average income and living costs in Spain, we can gain a deeper understanding of the economic landscape and the financial aspects that shape the lives of its residents.

Wealth Distribution in Spain: Revealing the Gap Between the Rich and the Rest

When it comes to wealth in Spain, an astonishing disparity exists between the rich and the majority of the population. This stark contrast has given rise to concerns about economic inequality and its implications for society. The distribution of wealth has become a topic of intense scrutiny, shedding light on the stark reality that only a small segment of the population is reaping the rewards of Spain’s economic prosperity.

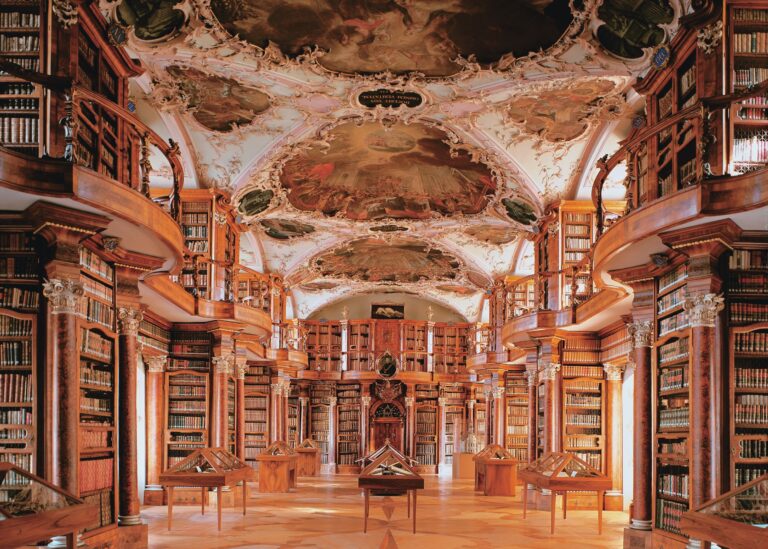

At the apex of this wealth pyramid, we find an elite group of individuals who enjoy immense fortunes, often accumulated through inherited wealth, lucrative businesses, or successful investments. These wealthy few reside in exclusive neighborhoods, live in opulent mansions, and have access to luxuries beyond imagination. Meanwhile, the vast majority of Spaniards struggle to make ends meet, navigate rising living costs, and contend with limited opportunities for economic advancement. This growing gap between the rich and the rest has far-reaching consequences, affecting not only financial stability but also social cohesion and quality of life for the average Spanish citizen.

Lifestyle Indicators of Richness in Spain: Uncovering the Markers of Affluence

When it comes to discerning the lifestyle indicators of wealth in Spain, there are several unmistakable markers that reveal the affluence of individuals. Embracing a life of luxury and abundance, the rich in Spain have certain habits and preferences that set them apart from the average population. Here are some key lifestyle indicators that give insights into their opulent way of living:

- Extravagant Residences: The wealthy in Spain often reside in magnificent mansions, opulent villas, or high-end penthouses situated in exclusive neighborhoods. These impressive residences boast exquisite architecture, grand gardens, private pools, and stunning views that epitomize luxury living.

- Sumptuous Fine Dining: Indulging their refined tastes, the wealthy take pleasure in exquisite gastronomic experiences at renowned Michelin-starred restaurants and exclusive dining clubs. They savor delectable delicacies prepared by world-class chefs, relishing the impeccable service and sophisticated ambiance.

- Designer Fashion: Rich Spaniards opt for designer clothing, adornments, and accessories that showcase their impeccable sense of style. They frequent high-end fashion boutiques and luxury brands to curate their wardrobe, embracing the latest trends and showcasing their exclusivity through elegant ensembles.

Continuing our exploration into the lifestyle indicators of affluence in Spain, here are more discernible traits that contribute to the lavish living of the rich:

- Elite Sporting Activities: The wealthy in Spain tend to participate in or support prestigious sporting activities like polo, sailing, golf, and tennis. They enjoy exclusive country clubs and yacht clubs where they engage in leisurely pursuits while networking with fellow affluent individuals.

- Luxurious Travel: A hallmark of their privilege, the rich in Spain embark on indulgent travels to both exotic and elite destinations around the world. They frequent luxurious resorts, sail on extravagant yachts, and enjoy private jet experiences, immersing themselves in lavish adventures that reflect their sophisticated taste for exploration.

- Cultural Patronage: Supporting the arts and culture, Spain’s wealthy engage in philanthropy and contribute to museums, theaters, and cultural institutions. Their patronage facilitates the preservation and promotion of Spanish heritage, with their names often adorning the walls of museums alongside priceless artwork.

By delving into these lifestyle indicators, we gain a deeper understanding of the lavish existence led by the wealthy in Spain. These markers of affluence encompass their living spaces, gastronomic preferences, fashion choices, pastimes, and cultural investments, collectively unveiling the opulence that distinguishes them in Spanish society.

Strategies to Attain Financial Success in Spain: Tips for Accumulating Wealth

Strategies to Attain Financial Success in Spain: Tips for Accumulating Wealth

Looking to secure a financially prosperous future in Spain? We’ve got you covered with practical strategies designed to help you accumulate wealth. Let’s dive right in!

1. Smart Saving: Make saving a priority by creating a budget that suits your lifestyle. Set aside a specific percentage of your income each month and ensure it goes straight into a savings account. Resist the temptation to dip into these funds unless it’s absolutely necessary. Small sacrifices today will pave the way for a financially comfortable tomorrow.

2. Invest Wisely: Explore various investment options to grow your wealth over time. Consider a diverse portfolio that includes stocks, bonds, real estate, and mutual funds. Conduct thorough research and seek professional advice to minimize risks and maximize returns. Remember, patience is your ally when it comes to investments; consistency and a long-term approach are key.

Navigating Spain’s Tax System: Minimizing Financial Burdens for the Wealthy

When it comes to managing your finances as a wealthy individual in Spain, navigating the country’s tax system can be a complex task. However, understanding the ins and outs of this system is crucial for minimizing your financial burdens. Here are some key strategies to help you make the most of Spain’s tax regulations:

- Research Tax Incentives: Take advantage of the numerous tax incentives available for the wealthy in Spain. Properly researching and understanding these incentives can help you reduce your tax liabilities significantly.

- Optimize Wealth Planning: Engaging in comprehensive wealth planning is essential for minimizing financial burdens. Utilize legal and financial professionals who specialize in Spanish tax regulations to develop effective strategies that align with your long-term financial goals.

- Consider Relocation: Relocating to a tax-friendly region within Spain or internationally can offer substantial tax advantages. Carefully analyze the residency rules to determine the most advantageous options for your particular situation.

Deductions and Exemptions: Familiarize yourself with the various deductions and exemptions available to high-income earners in Spain. By properly identifying and claiming these tax benefits, you can significantly lower your overall tax burden.

Stay Compliant: Ensuring compliance with Spain’s tax regulations is essential to avoid penalties and fines. Keep meticulous records of your financial activities and consult with professionals regularly to ensure that you are fulfilling your tax obligations accurately and on time.

FAQs

Q: What is the definition of being rich in Spain?

A: Being rich in Spain typically means having a high income or a substantial net worth that allows for a comfortable lifestyle and financial security.

Q: How much money is considered rich in Spain?

A: While there is no fixed amount that defines being rich in Spain, it generally depends on various factors like location, lifestyle, and personal circumstances. Nonetheless, an annual income above €70,000 or a net worth exceeding €500,000 can be considered quite comfortable.

Q: Are there regional differences in Spain regarding wealth?

A: Yes, regional differences do exist in Spain when it comes to wealth. Cities like Madrid and Barcelona tend to have higher living costs, influencing the notion of what is considered rich compared to smaller cities or rural areas.

Q: Can a high-paying job alone make you rich in Spain?

A: Having a high-paying job certainly helps in achieving financial success, but it does not guarantee being considered rich in Spain. Factors such as expenses, savings, and investments also play a significant role in determining wealth.

Q: What other factors are considered when determining wealth in Spain?

A: Besides income and net worth, factors like property ownership, investments, and access to healthcare and education are often taken into account when assessing wealth in Spain.

Q: Are there any cultural or societal implications of being considered rich in Spain?

A: In Spain, while wealth is often respected and admired, there is also a strong emphasis on a person’s character, humility, and contribution to society. Simply having money may not necessarily result in being highly regarded.

Q: What are some common perceptions of rich people in Spain?

A: Common perceptions of rich people in Spain may vary, but traits such as living in luxurious houses, driving expensive cars, and having access to exclusive leisure activities are often associated with wealth.

Q: How does Spain compare to other countries regarding wealth?

A: Spain falls within the top 20 nations in terms of GDP, and its average income is relatively high compared to other European countries. However, it should be noted that personal wealth can greatly differ among individuals within any country.

Q: Is being rich in Spain the same as being wealthy in other countries?

A: The definition of being rich or wealthy can differ from one country to another due to variations in living costs, economic conditions, and cultural perspectives. Therefore, what may be considered rich in Spain might not be the same as wealth in other nations.

Q: Is being rich in Spain synonymous with financial happiness?

A: While wealth can contribute to financial security and provide opportunities for comfort, being rich in Spain, as in any other country, does not guarantee overall happiness and well-being. Contentment comes from a combination of financial stability, personal relationships, and individual satisfaction.

Concluding Remarks

In conclusion, understanding what is considered “rich” in Spain comes down to perspective and individual circumstances. While there is no definitive answer, it is clear that having a high income or substantial wealth does play a significant role in attaining financial comfort and stability in this country. However, it is crucial to remember that true richness lies beyond monetary measures, encompassing aspects such as personal fulfillment, quality relationships, and overall well-being. So, whether you are aiming for financial success or seeking a more balanced definition of wealth, remember to prioritize what truly matters to you and your loved ones.