Do Foreigners Pay Tax in Monaco

Tax Obligations in Monaco: Do Foreigners Contribute?

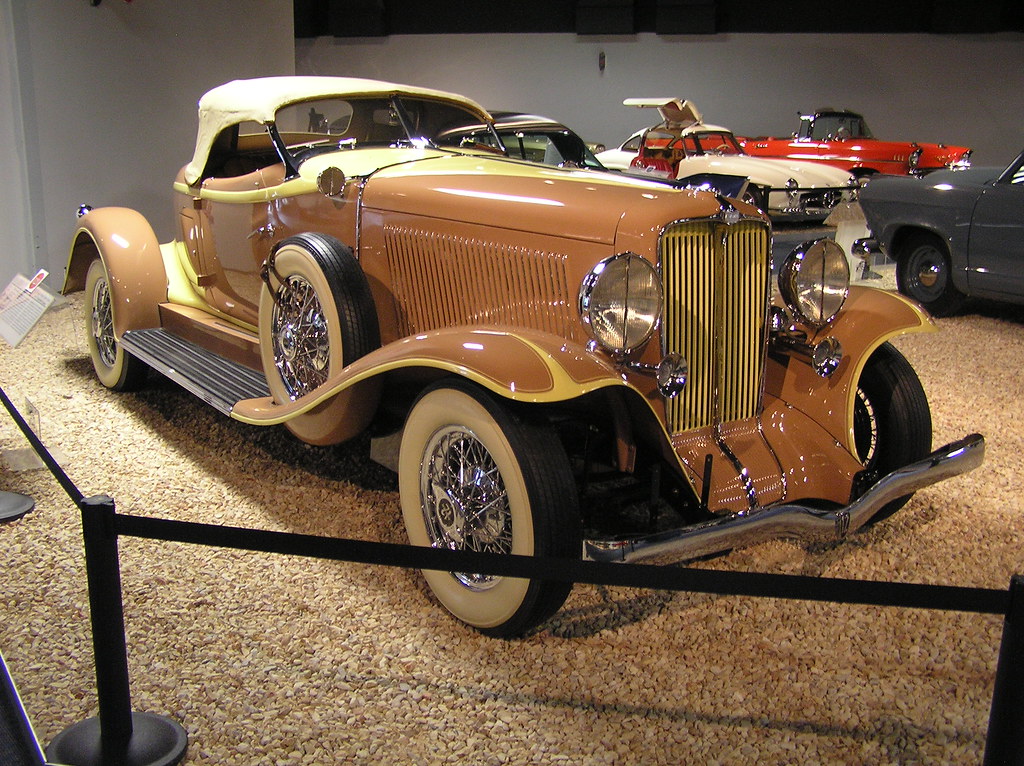

Welcome to the land of luxury, glitz, glamour, and stunning azure coastlines. Monaco, a tiny sovereign city-state nestled on the French Riviera, is renowned for its hedonistic lifestyle and tax-friendly policies. But amidst the grandeur, there’s a recurring question that lingers in the minds of many: do foreigners living in this opulent oasis pay taxes? Let’s delve into this burning inquiry and uncover the truth behind tax obligations in the haven of Monaco. Brace yourself, because we’re about to unravel the mysteries that surround taxation in this lavish Mediterranean paradise.

Table of Contents

- Overview of Monaco Tax System for Foreigners

- Understanding Taxation Laws for Non-Residents in Monaco

- Tax Exemptions and Benefits for Expatriates in Monaco

- Navigating the Double Taxation Agreements in Monaco

- Ensuring Compliance: Obligations and Responsibilities for Foreign Taxpayers

- Expert Advice: Maximizing Tax Efficiency for Foreigners in Monaco

- FAQs

- Concluding Remarks

Overview of Monaco Tax System for Foreigners

If you are considering relocating to the picturesque principality of Monaco, understanding its tax system is crucial for a smooth transition. Known for its attractive tax policies, Monaco offers significant advantages for foreigners seeking a favorable financial environment. Here’s a comprehensive overview of what you need to know.

No Personal Income Tax: One of the most appealing features of Monaco’s tax system is the absence of personal income tax for residents. Whether you earn through employment or investments, you won’t be required to pay any tax on your income. This advantage is especially valuable for high-net-worth individuals and expatriates looking to maximize their earnings.

No Capital Gains Tax: In Monaco, there is no capital gains tax imposed on the sale of stocks, bonds, real estate, or other assets. This exemption provides a significant incentive for foreigners wanting to invest and grow their wealth in the principality, as it allows for tax-efficient strategies and wealth preservation.

Understanding Taxation Laws for Non-Residents in Monaco

Monaco, renowned for its glamorous lifestyle and breathtaking views, has become a favored destination for non-residents seeking favorable taxation laws. Understanding the intricacies of Monaco’s taxation system is crucial for navigating the financial landscape in this idyllic principality.

So, what are the key points to grasp when it comes to taxation laws for non-residents in Monaco? Firstly, non-residents enjoy the significant advantage of not being subject to personal income tax. This means that the income earned outside of Monaco, even if remitted to a local bank account, is not taxed by the principality. This attractive feature makes Monaco an alluring choice for individuals seeking to optimize their financial status. Secondly, capital gains tax is also exempt for non-residents, allowing individuals to reap the benefits of their investment profits without worrying about additional tax burdens. This exemption applies to both financial assets, such as stocks and bonds, as well as tangible assets like real estate, making Monaco an enticing hub for investors worldwide.

Tax Exemptions and Benefits for Expatriates in Monaco

Monaco, the stunning Mediterranean principality, offers attractive tax exemptions and benefits for expatriates, making it a highly desirable location for individuals looking to optimize their financial situation. Moving to Monaco not only means basking in the azure beauty of the French Riviera, but also enjoying significant tax advantages that can contribute to a prosperous lifestyle.

1. No income tax: One of the most notable benefits for expatriates in Monaco is the absence of income tax. That’s right, residents of this enchanting city-state are not subject to paying any personal income tax, allowing them to retain a higher percentage of their hard-earned income. This favorable tax policy is undoubtedly a major draw for individuals seeking a tax-friendly environment.

2. No wealth tax: Another advantage for expatriates in Monaco is the absence of wealth tax. Unlike many countries that levy taxes on an individual’s total assets, Monaco does not impose any form of wealth tax. This means that individuals residing in Monaco can grow their wealth without the burden of additional taxation, providing a favorable environment for wealth accumulation and financial stability.

3. No capital gains tax: In addition to the above benefits, expatriates in Monaco need not worry about capital gains tax. Whether it’s from investments, real estate sales, or other capital gains, individuals in Monaco are not subjected to this type of tax. This exemption allows residents to freely invest, sell assets, or undertake business ventures without the looming tax implications that often accompany such financial activities.

4. Tax treaties: Monaco boasts numerous tax treaties with various countries worldwide, ensuring that expatriates can benefit from double tax agreements and avoid potential double taxation. These treaties help individuals avoid paying taxes twice, while also providing a framework for cooperation and shared tax responsibilities between Monaco and other participating countries.

Living as an expatriate in Monaco opens the door to unparalleled tax advantages that can enhance personal wealth and financial peace of mind. The combination of no income tax, wealth tax, or capital gains tax, along with beneficial tax treaties, creates an enticing environment for individuals seeking a tax-efficient lifestyle. With its picturesque landscapes and advantageous tax system, Monaco truly stands as an attractive destination for expatriates looking to maximize their financial well-being.

Navigating the Double Taxation Agreements in Monaco

Monaco, renowned for its luxurious lifestyle and breathtaking views, also boasts a favorable tax system that attracts individuals and businesses from around the world. One crucial aspect to understand when navigating the tax landscape in Monaco is the Double Taxation Agreements (DTAs) in place. These agreements serve as a shield against being taxed twice on the same income in two different countries.

Understanding the ins and outs of these DTAs is essential for individuals and companies looking to establish their presence in Monaco. Here are a few key points to keep in mind when dealing with Double Taxation Agreements in Monaco:

1. Coverage: Monaco has signed a number of DTAs with other countries, including France, Italy, and the United Kingdom, to name a few. These agreements outline the specific provisions for the prevention of double taxation, ensuring that you are not taxed multiple times on your income.

2. Residence and Permanent Establishment: The DTAs determine the criteria for determining an individual’s residence and a company’s permanent establishment. These factors play a significant role in determining which country has the right to tax your income.

3. Taxation on Different Types of Income: Double Taxation Agreements also establish rules for various types of income, such as employment income, business profits, dividends, and royalties. Understanding how each income category is treated under the DTAs will help you accurately assess your tax obligations in Monaco.

With this basic understanding of the Double Taxation Agreements in Monaco, you can confidently navigate the tax landscape and ensure that you optimize your tax situation while enjoying the splendors of this picturesque principality.

Ensuring Compliance: Obligations and Responsibilities for Foreign Taxpayers

Foreign taxpayers have certain obligations and responsibilities when it comes to ensuring compliance with tax laws. By understanding and meeting these requirements, individuals can avoid penalties and maintain a good standing with the tax authorities. Here are some key considerations for foreign taxpayers:

1. Filing a tax return: Foreign taxpayers must accurately report their income, deductions, and credits by filing an annual tax return. This process involves providing necessary documents, such as W-2 forms or 1099 statements, to support the declared financial information.

2. Understanding withholding: Foreign taxpayers may be subject to income withholding, where a portion of their earnings is held back by their employer or other income payers. It is important to comprehend the rules and regulations surrounding withholding to ensure proper tax deductions and avoid overpaying or underpaying taxes.

3. Claiming tax treaty benefits: Many countries have tax treaties with the United States to prevent double taxation on income. Foreign taxpayers should explore these treaty provisions to determine if they qualify for any exemptions or reduced tax rates.

4. Maintaining accurate records: Keeping detailed and organized records of income, expenses, and supporting documentation is crucial for foreign taxpayers. These records serve as evidence in case of an audit or any tax inquiries, ensuring that individuals can substantiate their tax filings.

5. Seeking professional assistance: Given the complexities of international tax laws, it is advisable for foreign taxpayers to consult with tax professionals who specialize in cross-border taxation. These experts can provide guidance, help navigate relevant deductions and credits, and ensure that all obligations are met in a timely and accurate manner.

By adhering to these obligations and taking on the corresponding responsibilities, foreign taxpayers can remain compliant with tax laws and minimize any potential issues or penalties that may arise. Understanding the specific requirements, seeking professional advice when needed, and maintaining proper documentation are vital aspects of ensuring tax compliance for individuals residing outside the United States.

Expert Advice: Maximizing Tax Efficiency for Foreigners in Monaco

How to Maximize Tax Efficiency as a Foreigner in Monaco

Are you a foreigner considering Monaco as your new home? Look no further! In this expert advice section, we will share valuable insights on how you can optimize tax efficiency as a foreign resident in the luxurious city-state of Monaco. While Monaco is renowned for its tax advantages, it’s crucial to have a clear understanding of the local tax system and implement strategies that align with your financial goals. Below, you will find key tips and recommendations to help you navigate the tax landscape in the most efficient way:

- Become a tax resident: By becoming a tax resident of Monaco, you can benefit from the country’s attractive tax regime. To qualify as a resident, you must spend at least 183 days per calendar year in the principality, establish a physical presence, and not maintain significant ties to any other country. Consult with a professional advisor to ensure you meet all the residency criteria and take advantage of the associated tax benefits.

- Optimize Monaco’s non-resident status: If you can’t fulfill the requirements to become a tax resident, explore the option of obtaining Monaco’s non-resident status. This allows you to benefit from a fixed annual tax liability based on your level of income sourced within Monaco. By structuring your affairs appropriately and managing your sources of income, you can minimize your tax obligations and maximize your overall tax efficiency.

- Navigate the exemptions and deductions: Familiarize yourself with the various tax exemptions and deductions available in Monaco. For example, you can take advantage of exemptions related to capital gains, wealth tax, and inheritance tax. By understanding these exemptions and incorporating them into your financial planning, you can effectively reduce your tax liability and optimize your overall tax efficiency in Monaco.

Remember, seeking professional advice in tax matters is essential to ensure compliance with local regulations and make informed decisions tailored to your specific circumstances. By implementing these strategies and seizing the opportunities offered by Monaco’s tax system, you can maximize your tax efficiency and enjoy the financial advantages of this vibrant principality.

FAQs

1. Q: Do foreigners living in Monaco have to pay taxes?

A: Generally, foreigners residing in Monaco are exempt from paying personal income tax.

2. Q: Are there any specific criteria for foreigners to be considered tax residents in Monaco?

A: Yes, to be considered a tax resident in Monaco, foreigners must live in the country for at least 183 days a year.

3. Q: Do foreigners pay any taxes at all in Monaco?

A: While personal income tax is not applicable, foreigners may still be subject to other taxes such as property tax and value-added tax (VAT).

4. Q: Are there any benefits for foreigners living in Monaco in terms of taxation?

A: Yes, one of the main benefits is the absence of personal income tax, which can be advantageous for high-income individuals.

5. Q: Can foreigners establish businesses in Monaco without paying taxes?

A: Monaco offers favorable business conditions, including low corporate taxes, making it an attractive location for foreign entrepreneurs.

6. Q: Are there any potential challenges for foreigners regarding tax residency in Monaco?

A: Establishing and maintaining a genuine residence in Monaco might be necessary to avoid challenges from tax authorities of other countries claiming tax residency.

7. Q: How does Monaco ensure compliance with its tax regulations by foreigners?

A: Monaco has stringent residency requirements and monitors individuals’ presence through various means to ensure compliance.

8. Q: Can foreigners benefit from Monaco’s tax treaties with other countries?

A: Monaco has entered into several tax treaties to prevent double taxation, ensuring that individuals don’t pay taxes on the same income to multiple countries.

9. Q: Is Monaco considered a tax haven for foreigners?

A: Monaco’s tax advantages have led many to view it as a tax haven, but the country has taken steps to enhance transparency and international cooperation.

10. Q: What is the significance of Monaco’s territorial taxation principle?

A: Monaco only taxes income generated within its borders, making it particularly appealing for foreigners with international investments.

11. Q: Are there any exceptions to the tax rules for specific professions?

A: Some professions, such as financial services, are subject to different tax regulations, which may impact foreigners working in these fields.

12. Q: How does the lack of personal income tax in Monaco affect its social services?

A: The absence of personal income tax is balanced by other sources of revenue, such as property taxes and VAT, which contribute to funding social services.

13. Q: Can foreigners invest in real estate in Monaco without facing heavy taxation?

A: While real estate transactions in Monaco can be subject to taxes, they are generally lower than in many other countries.

14. Q: Do foreign retirees in Monaco have any special tax considerations?

A: Monaco offers a “pensioners’ residence” program with specific criteria and tax benefits for retirees.

15. Q: How does Monaco’s tax system compare to neighboring countries like France?

A: Monaco’s tax advantages often draw comparisons with neighboring countries, where personal income tax rates are generally higher.

16. Q: Can foreigners open bank accounts in Monaco without facing tax implications?

A: Foreigners opening bank accounts in Monaco should be aware of their home country’s regulations to ensure compliance with reporting requirements.

17. Q: Are there any restrictions on foreigners bringing wealth into Monaco?

A: Monaco has strict regulations to prevent money laundering and requires individuals to prove the legitimacy of their wealth when moving to the country.

18. Q: How does Monaco handle inheritance and gift taxes for foreigners?

A: Monaco does not levy inheritance or gift taxes, which can be an appealing aspect for individuals planning their estate.

19. Q: What role does international cooperation play in Monaco’s tax policies?

A: Monaco has engaged in international efforts to increase transparency and combat tax evasion, aligning with global standards.

20. Q: Can foreigners maintain dual tax residency between Monaco and another country?

A: While dual tax residency can sometimes occur, it’s important to navigate the tax regulations of both countries to avoid any conflicts or double taxation.

To Wrap It Up

In conclusion, the tax status of foreigners in Monaco is quite straightforward. While residents of Monaco are typically exempt from paying income tax, this beneficial treatment does not automatically apply to non-residents. Foreigners who spend less than 183 days per year in the country are generally not subject to income tax. However, if a non-resident earns income in Monaco, they may still be liable for tax in their home country. It is important for foreigners residing or working in Monaco to understand their tax obligations and consult with a professional if necessary. Ultimately, the tax rules in Monaco are designed to attract foreign individuals and businesses, providing a favorable environment for financial growth and prosperity.